Economy

Treasurer, Josh Frydenberg, has delivered the Coalition Government’s Federal Budget 2020-21. Key economic parameters and tax and superannuation Budget initiatives include:

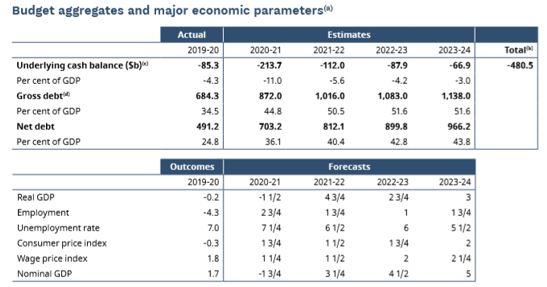

The Commonwealth Government deficit is expected to reach $213.7 billion this year, falling to $66.9 billion by 2023-24. Net debt will increase to $703 billion or 36 per cent of GDP this year and peak at $966 billion or 44 per cent of GDP in June 2024.

The Government’s revised fiscal strategy includes two phases – a COVID-19 Economic Recovery Plan that targets job creation; and a medium-term phase focused on stabilizing and then reducing debt as a share of the economy once the unemployment rate is below 6 percent.

Taxation

The Morrison Government will deliver significant tax relief as part of their Economic Recovery Plan for Australia to create jobs, rebuild the economy and secure Australia’s future.

Bringing forward Stage two of the Personal Income Tax Plan will see more than 11 million taxpayers get a tax cut backdated to 1 July 2020. Business will be supported with time-limited tax incentives that will provide immediate expensing and loss carryback.

Tax relief for individuals:

As part of the 2020-21 Budget the Government will bring forward Stage two of our Personal Income Tax Plan by two years. From 1 July 2020:

- the low income tax offset will increase from $445 to $700;

- the top threshold of the 19 per cent tax bracket will increase from $37,000 to $45,000; and

- the top threshold of the 32.5 per cent tax bracket will increase from $90,000 to $120,000.

In 2020-21, low-and middle-income earners will receive a one-off additional benefit of up to $1,080 from the low and middle income tax offset (LMITO). More than 7 million individuals are expected to receive tax relief of $2,000 or more for the 2020-21 income year compared with 2017-18 tax settings. Low and middle income tax payers will receive relief of up to $2,745 for singles and $5,490 for dual income families.

Tax relief for business:

Businesses with a turnover of up to $5 billion will be able to immediately deduct the full cost of eligible depreciable assets acquired from 7:30pm (AEDT) on 6 October 2020 and first used or installed by 30 June 2022.

The Government will temporarily allow companies with a turnover of up to $5 billion to offset tax losses against previous profits on which tax has been paid. Losses incurred to June 2022 can be offset against prior profits made in or after the 2018-19 financial year.

The Budget provides $105 million in tax relief to expand access to a range of small business tax concessions by lifting the aggregated annual turnover threshold for these concessions. Businesses with an aggregated annual turnover between $10 million and $50 million will be able to access up to ten small business tax concessions. he expanded concessions will apply in three phases, with the first phase starting from 1 July 2020.

The Government will also enhance previously announced reforms to invest an additional $2 billion through the Research and Development Tax Incentive. These changes will commence from 1 July 2021 and help more than 11,400 companies that invest in research and development.

Superannuation:

Commencing 1 July 2021, the Your Future, Your Super package will improve the superannuation system by:

- Having your superannuation follow you: preventing the creation of unintended multiple superannuation accounts when employees change jobs.

- Making it easier to choose a better fund: members will have access to a new interactive online YourSuper comparison tool which will encourage funds to compete harder for members’ savings.

- Holding funds to account for underperformance: to protect members from poor outcomes and encourage funds to lower costs the Government will require superannuation products to meet an annual objective performance test. Those that fail will be required to inform members.

- Increasing transparency and accountability: the Government will increase trustee accountability by strengthening their obligations to ensure trustees only act in the best financial interests of members. The Government will also require superannuation funds to provide better information regarding how they manage and spend members’ money in advance of Annual Members’ Meetings.

Jobmaker hiring credit

A $4 billion JobMaker Hiring Credit will be payable for up to 12 months for each new job and is available from tomorrow to employers who hire eligible employees aged 16-35. The Hiring Credit will be paid quarterly in arrears at the rate of $200 per week for those aged between 16-29, and $100 per week for those aged between 30-35.

Eligible employees are required to work a minimum of 20 hours per week. To be eligible, employers will need to demonstrate an increase in overall employee headcount and payroll for each additional new position created.