Job keeper extension 1

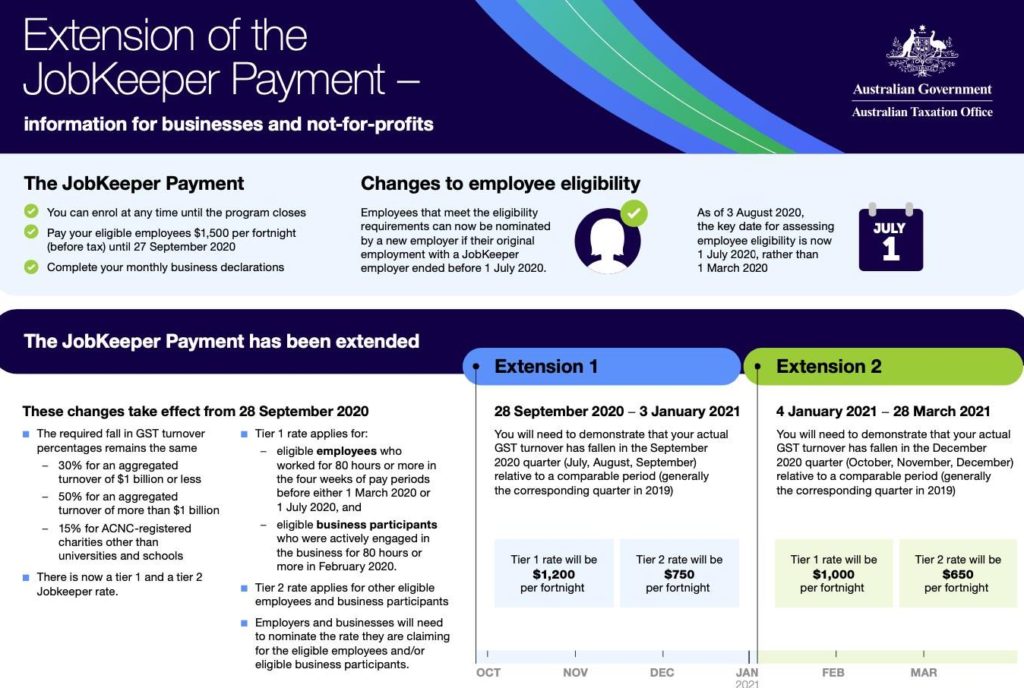

This extension period will run from 28 September 2020 to 3 January 2021.

You will need to show that your actual GST turnover has declined in the September 2020 quarter relative to a comparable period (generally the corresponding quarter in 2019). See the actual decline in the turnover test.

You also need to have satisfied the original decline in turnover test. However, if you:

- were entitled to receive Job Keeper for fortnights before 28 September, you have already satisfied the original decline in the turnover test

- are enrolling in Job Keeper for the first time from 28 September 2020, if you satisfy the actual decline in the turnover test, you will also satisfy the original decline in the turnover test (except for certain universities). You can enroll on that basis.

The rates of the Job Keeper payment in this extension period are:

- Tier 1: $1,200 per fortnight (before tax)

- Tier 2: $750 per fortnight (before tax).

Job keeper extension 2

This extension period will run from 4 January 2021 to 28 March 2021.

You will need to show that your actual GST turnover has declined in the December 2020 quarter relative to a comparable period (generally the corresponding quarter in 2019). See the actual decline in turnover test.

You also need to have satisfied the original decline in turnover test. However, if you:

- were entitled to receive Job Keeper for fortnights before 28 September, you have already satisfied the original decline in turnover test

- are enrolling in Job Keeper for the first time from 28 September 2020, if you satisfy the actual decline in turnover test, you will also satisfy the original decline in turnover test (except for certain universities). You can enrol on that basis.

You can be eligible for Job Keeper extension 2 even if you were not eligible for Job Keeper extension 1.

The rates of the Job Keeper payment in this extension period are:

- Tier 1: $1,000 per fortnight (before tax)

- Tier 2: $650 per fortnight (before tax).